How to Manage Your Money Safely on the Road in Latin America

A Realistic Guide by a Long-Time Expat

Article and photos by Ted Campbell

Updated 5/8/2024

|

|

The essentials for managing your money in Latin America.

|

Her eyes fill with tears. “What am I going to do?”

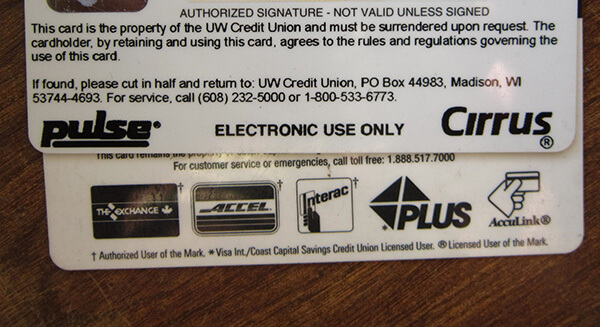

I take my U.S. debit card out of my wallet. I show her the little symbols on the bottom — Cirrus and Pulse. I take out my Canadian card — The Exchange, Accel, Interac, Plus, and Acculink.

“See how yours doesn’t have any,” I say.

“But it’s a Visa!”

What can I say? The card doesn’t work. You can’t argue with an ATM machine.

We’re standing outside our third ATM in 30 minutes. Merida is hot in the early afternoon. Hours from the beaches of Cancun and Playa del Carmen, the capital of Mexico’s Yucatan state is surrounded by deep green jungle. Sweat beads on the foreheads of people passing on the narrow, crowded sidewalk. Club hits blast from discount clothing stores, somehow making the day even hotter.

“Well, I have another card back at the hostel. It might have those symbols,” she says.

We go back. Her card has lots of symbols. “Remember, find an ATM with the same symbol,” I say. “Do you want me to go with you?”

“No, I’ll be fine.”

Five minutes later she bursts into the room, tears flowing. “The machine ate my card!”

We run downstairs to the ATM in the OXXO convenience store next door. Sure enough, none of the magic symbols from the backs of our cards are pasted on it. It isn’t even an international ATM, but for a local Mexican bank. I see no point in repeating what I have been saying all afternoon. I give her a hug and tell her not to worry.

“I just want to go back to England,” she says.

A Common Money Problem

When I meet travelers on the road who are having money problems, it’s rarely because they ran out of money or got robbed. Usually they don’t understand the different kinds of ATMs and debit cards. Perhaps they don’t know their bank’s policies. Perhaps they have been ripped off changing money on the street or while crossing borders.

Quite simply, they didn’t prepare. They assumed that something they took for granted back home, money and banking, would be the same overseas.

Understand ATMs

Debit cards are essential for travel. ATMs give decent exchange rates and are usually easy to find. But you must understand them first.

In general, there are two kinds of ATMs: ones that are connected to banks and ones that aren't. The ones connected to banks almost always have lower fees, sometimes much lower, than the "tourist" ATMs found in malls, convenience stores, and elsewhere.

But just because it's in a mall or convenience store, it doesn't mean it's not a bank ATM. They should be easy to distinguish, with the name of the bank displayed prominently.

Furthermore, in Mexico and in many other countries too, there are two kinds of bank ATMs: ones for local cards only and ones that work with international cards too.

To know the difference, look for logos of international exchange networks on the ATM. Some of these include Cirrus, Pulse, the Exchange, MoneyPass and Allpoint. If none of these logos are on the ATM, then it’s probably for local banks only.

|

|

It is very important to know how to read the symbols on your ATM card when you travel in Latin America.

|

More than a decade ago, when I was helping my new friend in Merida, nearly all debit cards contained some of these logos, so you could quickly match the logo on your card to the one on the ATM for the lowest fees. Now, for some reason, many cards don’t.

You’ll need to check your bank’s website to see which networks they use and to find ATMs that are part of the network. Most bank websites also have locators to find nearby ATMs, although this may not work internationally.

Besides this, the best way to save money on ATM withdrawals is to use a bank account that doesn’t charge for international transactions.

At the time of writing, Capital One doesn’t charge for international transactions, and the Charles Schwab checking account doesn’t charge for international transactions and also refunds all ATM fees. Before opening an account with either of these financial institutions, confirm that these policies are still current.

Another crucial way to save on ATM withdrawals is to choose “no” if you’re given the option to exchange the currency with the local bank while using the ATM.

Some variation of “Would you like to convert to Mexican pesos?” may be displayed on the screen near the end of the process. It should also show how much your account will be charged in your currency for the corresponding amount in the local currency.

Your first reaction may be to choose "yes," but always choose “no,” which means that your bank will make the currency exchange instead. In my experience, in Mexico and in many other countries, choosing “no” will save you 10% or more.

You can even check to see exactly how much money you saved. Because the ATM shows what you would have been charged by choosing “yes,” you can easily compare that number to what your account was actually charged. (And if it didn’t save you money, take it as a sign that your bank gives terrible rates for currency exchange.)

A final note about ATM fees: Some countries always charge an unavoidable fee for ATM withdrawals using international cards. In Thailand, for instance, it's $5 per withdrawal (plus whatever the ATM charges on top of that).

In that case, you're better off withdrawing large amounts, but make sure to keep that cash safe. See the section on safety later in this article for advice about that.

At the time of writing, I'm not aware of any Latin American countries that do this, but it can't hurt to search online for up-to-date information before your trip.

Understand Your Bank

You'll have to do some research, but you'll find important differences among banks and bank accounts. It’s vital that you know how much your bank charges for international transactions.

Some banks charge 1% or 2% on top of the currency exchange, which may not seem like much but can quickly add up. PayPal charges a 4.5% conversion service charge, which is way too much, so I never use it for international payments.

Learn all about your bank’s policies, and not only about international transactions, but overdraft fees and any other service charges. If you don't like what you see, don't hesitate to get a new bank. Your old bank will make an excellent backup.

Communicating with your bank at some point before your trip is worthwhile. Most banks allow you to submit travel plans online. Always do this, because it will prevent your card from getting locked.

If you can’t submit travel plans online, or if you can’t figure out the fees for using your card internationally, then before your trip make a quick phone call to your bank. You’ll get an idea during this exchange how they would treat you if you had a problem. Lost in voicemail, or stuck on hold too long? Find a new bank.

One more tip: If you plan on working abroad and sending money home, make sure your bank in your home country has a SWIFT code. Some don’t, and if yours doesn’t, you may not be able to send a wire transfer to it from banks in some countries.

Always Have Backups when Traveling

Travel with several cards. You never know when you’ll lose one. I’ll never forget the day in La Paz, Bolivia, when I strolled away from the ATM, went two blocks and realized I had left the card in the machine. I ran back and it was gone.

I had a backup card, but it didn’t work. So I waited two weeks for the new card to come, running up tabs in the hotel and my favorite bar up the street. But my bank mailed me the card relatively quickly and didn’t charge me for it.

Now I travel with many cards, from several different countries even. But the easiest way is to just open a second or third checking account in the same bank and get a card for each. If it isn’t free, change banks, or open a new account in another bank (one with no fees for international transactions, of course).

Cash Money

Aside from withdrawing from ATMs, I avoid using my debit card while traveling in Latin America. Cash is accepted everywhere, and paying for purchases with a debit or credit card may incur extra charges, or worse, get your card number stolen.

You can wait to withdraw cash on arrival from a bank ATM in the airport, but don't use the currency exchange booths, which give poor rates. Pay attention: The rates are usually worse inside the baggage claim than inside the terminal.

Instead, look for a currency exchange center back home, which usually gives better rates than banks. If you can't find one, however, a bank should still be better than the airport.

If you plan on visiting multiple countries, bring some U.S. dollars as a backup. You will always get better exchange rates at borders, and dollars can be exchanged almost everywhere.

I usually travel with between $100-200 USD in 20-dollar bills. I try not to use them unless I have no other choice. Trekking to some crazy out-of-the-way place and finding out that they don’t have an ATM isn’t much fun if you want to stay awhile.

If it isn’t the U.S. dollar, then I’m sure most parts of the world have some other most-desired currency, such as Euros. Find out what it is beforehand and bring some.

Checking exchange rates is easy. Do it online using your favorite search engine or a currency conversion website such as OANDA.com. Compare the rate over time while abroad to see how it fluctuates.

Traveling Safely

Now you have a stack of debit cards and some tasty U.S. dollars. Sounds a little dangerous?

Getting robbed is always possible while traveling. The odds go up and down in certain parts of the world, but if you are staying in hostels, in a room full of bunk beds, then you should be very careful.

My first line of defense is a thin money belt that fits under my pants. Some people — especially girls — use a small pouch that hangs around their neck.

You keep the essentials here — passport, debit cards, and any backup cash (like U.S. dollars) or local currency you won’t be spending that day.

I don’t carry this at all times, only when I’m traveling between places. When I have a place to stay, I leave it in my room. Some travelers use the safe deposit box of a hotel. Even cheap places might have a safe under the front desk. Just be careful when you ask — don’t imply you are carrying a treasure!

I have a small corner of my backpack to hide it in. Or you can wrap it up in old clothes and stuff it down to the bottom. Hollow out a book and tie it with a rubber band. You get the idea. But only hide stuff in your backpack when you leave the backpack in your room. While taking buses or other public transportation, you want that pouch to be out of sight and touching your skin.

That reminds me — put your cash and passport in a Ziploc bag to keep them from getting drenched with sweat on a hot bus in a hot country.

Prepare for a Robbery

One more thing: there’s no point in having all this money hidden if you have nothing else to give a robber. You will end up yanking out the money belt to appease him.

When I’m in dangerous places, I carry money on me in three places. The essentials and whatever I’m sure I won’t need is in the money belt. Whatever I will use that day is in small bills in my front pocket, in a wallet or not. And whatever backup cash I might need, I stuff into my socks.

Sounds paranoid? Think about what it’s like getting robbed at knifepoint. What does that robber want? He wants a foreigner’s wallet stuffed with bills (even if they are all small bills) and a quick getaway. Make sure that you can provide it.

Currency Exchange at Border Crossings

A day or two before you cross the border, go online and check exchange rates. For example, last summer when I crossed from Guatemala to Mexico, I found that the rate was 1.65. This means that 100 Guatemalan quetzales will get you 165 Mexican pesos. But I’m bad with math, so I wrote down how much the total in quetzales I would most likely be exchanging is worth in pesos. I did the same for U.S. dollars.

Speaking the local language will help, but it isn’t essential. Carry your cheat sheet and a pen, or think about getting a small calculator. Borders are full of moneychangers, and if you sound like you know what you are talking about you will get a good exchange rate, sometimes even better than the official one. If you are clueless, you will get ripped off, big time.

Again, this is where U.S. (or some other) money might come in handy. If you are getting bad rates for local currency (especially if you will be going back to the country and don’t mind carrying it), then you might get a better rate for dollars or another currency.

Crossing borders can be intimidating. Research as much as you can — not only exchange rates but also what to expect in terms of visa requirements, which are subject to change. Know where, how far apart, and how far from the next bus station the immigration offices are.

Many people take shuttles across borders with big groups of tourists. The idea is to save time and money, but in my experience they are expensive and sometimes very slow, especially in the morning when they drive all over town to everyone’s hotel.

Also, the few times I’ve done this I’ve seen rip-offs. At the Guatemalan/Mexican border on the road between Tikal and Palenque, the group was warned several times on the way about the Guatemalan exit fee. They all lined up to get their stamp, money in hand.

I knew this wasn’t true, so I asked for a receipt. I knew they couldn’t give me one. They saw all the other Guatemalan stamps in my passport and just waved me on.

I don’t suggest you try to make a stand against a suspected rip-off. Just quietly ask for a receipt.

Later on the same trip our van was stopped in Mexico. Officials asked us for a fee of about 80 cents. A couple refused. I asked for a receipt and got it — a fee for the national park/nature reserve we were passing through.

The angry couple refused a legit national park fee but had paid the bogus border-crossing fee. It was quite embarrassing to wait in the hot, crowded passenger van for ten minutes until they finally relented and paid.

The Last Word on Money and Traveling

Time is money. Money is power. Money is the

root of all evil. And so forth...

Money is also your ticket to a great trip in a far-off part of the world. Or it can be a source of frustration and heartbreak, like what happened to my friend in Merida.

She was fine. The guy she was traveling with agreed to lend her money until they reached Cancun, where she would meet her sister.

I pictured them running around town, putting cards with no magic symbols in every ATM they found. Had she learned her lesson? Somehow I doubted it. Some people can be strange when it comes to dealing with money — they seem to not want to think about it, to understand it. They choose to have unprotected ATM use and assume that everything will be all right.

Sometimes it isn’t. With money and traveling, ignorance is anything but bliss.

|

Ted Campbell is a freelance writer, Spanish-English translator, and university teacher living in Mexico.

He has written two guidebooks (ebooks) about Mexico, one for Cancun and the Mayan Riviera and another for San Cristobal de las Casas and Palenque in Chiapas, both also available at Amazon.com or on his website.

For stories of adventure, culture, music, food, and mountain biking, check out his blog No Hay Bronca.

To read his many articles written for TransitionsAbroad.com, see Ted Campbell's bio page.

|

|